Decision making under risk:

Applicability of the

advantages first principle

SE367 Term Project

Shantanu Saraswat

This project seeks to use the paper on "Information Search and Mental Representation in Risky Decision Making: The Advantages First Principle" by OSWALD HUBER, ODILO W. HUBER and ARLETTE S. BAR as a base. We would like to use the results of the paper and try to explain the few anomalies in the results. Also, another paper "EXPERIMENTS ON RISK ATTITUDE: THE CASE OF CHINESE STUDENTS" by Shunichiro Sasaki, Shiyu Xie, Fumio Ohtake, Jie Qin and Yoshiro Tsutsui, has been studied and is used to provide a basis for the hypothesis that we wish to verify as part of the term project.

Advantages first principle

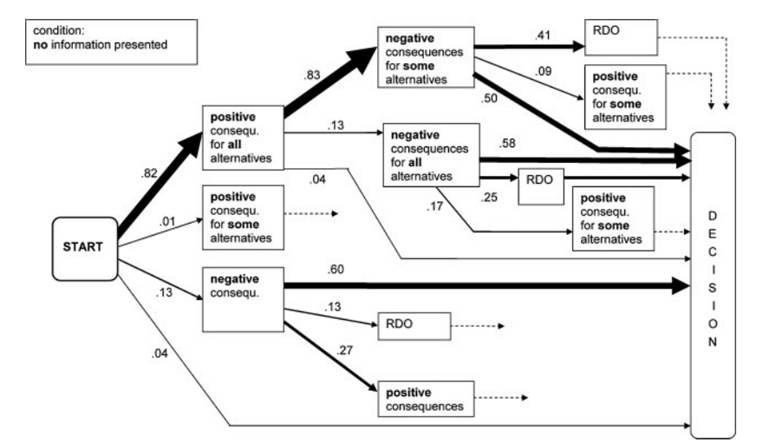

The advantages first principle simply states that in a case where one has to make a risky decision by choosing one alternative among several presented, one tends to gather information about the positive aspects (gains) of each alternative first. After short listing the alternatives based on this initial information, one looks for the negative aspects for only those alternatives which were short listed (promising alternatives) in the first step. After this step, the subject may seek to find some way of minimizing the risk (risk defusing operator) before finally selecting an alternative.

Research done by Huber et al.

Huber and his colleagues performed a series of experiments which verified the "advantages first principle" in situation where time was not a constraint. Huber and Kunz (2007) tried to study the effect of time-pressure on risky decision making and found that when time-pressure was applied, decision makers tended to search for information about the negative consequences first. In conditions without time-pressure, the advantages first principle was invariably confirmed.

There were 3 experiments done under this research paper. The first two aimed two verify the advantages first principle when a large number (8) of alternatives were available, and when a small number (2) of alternatives were available to the decision maker. The third experiment aimed to study the applicability of the principle in general risky decision making tasks (like those in the first two experiments) compared with gambling tasks involving money. In the third experiment, it was observed that although the second part of the advantages first principle was verified in the gambling case, the search done (information about positive/negative consequences retrieved) was much larger than in the other cases. Huber and his collaborators' research was not able to explain these results, however they gave two possibilities which could have led to the situation. It is these possibilities that we will examine in the term project.

The possibilities leading to the anomaly in the result were-

(1) All gambles correspond to the same cognitive schema of a gamble with identical elements (wins, losses, and probability). All alternatives might therefore be represented structurally in an identical manner. This reduces information load compared with the maki* task because here more elements like negative events and causal relations may be comprised in the representation. Furthermore, in the gambles choice tasks, far fewer questions were asked: A mean number of 25.90 questions in the gambles choice tasks with eight alternatives compared to 34.20 in the maki* scenario, also with eight alternatives. The smaller information load in the gambles choice tasks could have led participants to search more for negative consequences.

(2) The possibility of really losing money could lead to a more thorough information search.

-Huber et al. Information Search and Mental Representation in Risky Decision Making: The Advantages First Principle

* maki scenario was one of the scenarios presented to the decision makers and is discussed in more detail below.

The general risky decision making scenarios were of two types-

- The participant is the manager of a program to protect the endangered maki species of monkeys. The participant is supposed to protect the maki by relocating them to one of 8 (or 2 in the second experiment) places all of which had different advantages and disadvantages.

- The participant is the manager of a parcel enterprise which has been overrun by the huge number of parcels because of the holiday season. The participant is expected to choose a place to rent in order to store the extra parcels. All alternatives have their own advantages and disadvantages.

P.S. - In both the scenarios described above, the advantages and disadvantages were varied in steps of two - moderate and high.

Research done by Sasaki, Xie, Ohtake, Qin and Tsutsui

This paper was based on an elaborate experiment which involved the participants buying and selling lottery tickets by assessing and quoting prices for the same and negotiating deals with the computer. The paper concluded that overall, people were more risk averse in the experiment. Breaking down the results, people were more risk averse in buying the tickets, while they were more risk loving when selling the tickets. This suggested the presence of the endowment effect which should be avoided while formulating the experiment.

Endowment effect: The endowment effect states that individuals tend to value things which they own more than similar things which they do not own.

Proposed Project

The project will conduct a set of two experiments. One would be the main experiment which would involve actual gain and loss of money. The other would be the control experiment which would be essentially the same as the first one except that the reward would not be money, but would instead be something of no value to the participant (such as a matchstick or a piece of wire).

Hypothesis - Participants are expected to search more in case of monetary (relevant) gain/loss as compared to the case with non-relevant gain/loss.

Each experiment should have 15-20 participants.

Experiment 1

The participant would be given 50/- as starting money for the gamble. They would then be presented with 4 gambles/choices - A, B, C, and D.

Initially, no information about A, B, C, and D will be provided. The participants would be free to ask questions about the choices. The choices would simple 'coin flip' gambles with different win/loss amounts. Each choice would be one of the following-

- Win - get 75/-, Lose - give up 50/-

- Win - get 75/-, Lose - give up 30/-

- Win - get 50/-, Lose - give up 50/-

- Win - get 50/-, Lose - give up 30/-

Here there are two levels of positive consequences as well as negative consequences.

The participants are free to ask the following questions about the choices-

- What will I get if I win choice X?

- What will I lose if I lost at choice X?

Here X can be A, B, C, or D.

Experiment 2

Here the money would be replaced by matchsticks.

The participant would be given 10 matchsticks as starting currency for the gamble. They would then be presented with 4 gambles/choices - A, B, C, and D.

Initially, no information about A, B, C, and D will be provided. The participants would be free to ask questions about the choices. The choices would simple 'coin flip' gambles with different win/loss amounts. Each choice would be one of the following-

- Win - get 15 sticks, Lose - give up 10 sticks

- Win - get 15 sticks, Lose - give up 6 sticks

- Win - get 10 sticks, Lose - give up 10 sticks

- Win - get 10 sticks, Lose - give up 6 sticks

Here there are two levels of positive consequences as well as negative consequences.

The participants are free to ask the following questions about the choices-

- What will I get if I win choice X?

- What will I lose if I lost at choice X?

Here X can be A, B, C, or D.

There would also be several manipulation checks in place as well to verify whether the subjects indeed saw a difference in the risks involved.

Discussion - If proved, the hypothesis would support the second point put forward by Huber et al. while trying to explain the anomalous results. If the hypothesis is not proved, on the other hand, it may indicate that a low cognitive load is responsible for the huge information search. However, this would need a more specific experiment to confidently prove.

References

HUBER, ODILO W. HUBER and ARLETTE S. BAR (2010). Information Search and Mental Representation in Risky Decision Making: The Advantages First Principle. Journal of Behavioral Decision Making.

Shunichiro Sasaki, Shiyu Xie, Fumio Ohtake, Jie Qin and Yoshiro Tsutsui (2006). EXPERIMENTS ON RISK ATTITUDE: THE CASE OF CHINESE STUDENTS. China Economic Review.

Rob Ranyard, W. Ray Crozier, Ola Svenson (1997). Decision making: cognitive models and explanations.